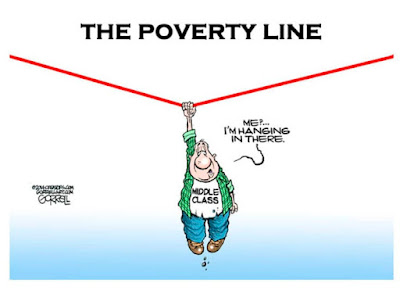

It is that time of the year when the talk on tax slabs heats up and #Budget2022 was no different in evoking another set of strong yearly reactions with the Finance Minister not even tinkering the slabs & slab rates to the benefit of the salaried and middle class. The economy & citizenry was hit by the pandemic, especially so by the second wave which recorded a significant loss of lives & livelihood. If ever there was a time of extending relief and mitigating the slipping back of families into 'poverty', this was it. Yet, the GoI severely disappointed the middle class and hence the natural outpouring of justified emotions. There was a time when taxing was considered a sanctioned loot by the government; from there, we have reached a point where I see so many positive voices expressing that taxes are being put to good use and hence the resistance of these individuals to governments collecting personal income tax has reduced significantly. From a blanket pessimistic view, this year's budget has witnessed a progressive and constructive expression of angst that the middle class income taxes are the major financiers of the welfare & freebies. In today's blog, I seek to explore this statement.

If one were to refer to the 2022 budget details by PRS and check the section on GoI's revenue receipts, it can be observed that for year ending Mar 2022 (Assessment Year 2021-22, for tax purposes), GoI is expected to earn Rs. 25,16,059 crore in gross tax revenue; additionally, GoI would earn Rs. 3,13,791 crore as non-tax revenue and Rs. 99,975 crore in the form of capital receipts (mostly, divestments from public sector holdings). The three numbers aggregated work out to Rs. 29,29,825 crore as Total GoI revenues (TGR). The top three contributors to TGR would be GST (Rs. 6,75,000 crore; 23.0% of TGR), Corporate Tax (CT; Rs. 6,35,000 crore; 21.7% of TGR) and Personal Income Taxes (PIT; Rs. 6,15,000 crore; 21.0% of TGR). The last metric, i.e. PITs contributing 21.0% to TGR is the key number to take ahead in this blog.

Note: I have purposefully picked up the yet-to-complete-year ending Mar 2022 rather than the previous one as it would offer the most recent data which would include the second and third waves of the pandemic as well and thereby, a more realistic assessment of the realities of today. This comes at a small sacrifice that ~2 months of data would be estimate which doesn't make a statistically significant difference as can be seen in the remainder of the blog.

Now, 5.89cr ITRs have been filed till the 31st Dec 2021 deadline and these correspond to the 21.0% contribution to TGR from PITs (it would have been marginally higher at 21.3% had I chosen the data set for year ending Mar 2021 rather than Mar 2022). This means that out of every Rs. 100/- that GoI earns, Rs. 21/- is being contributed by all us 5.89cr income tax payers. Of these 5.89cr filings, 2.92cr have filed ITR1 and 0.548cr have filed ITR2 (the difference between various ITRs can be checked out here or on the IT Dept. website). After referring to the ITR guide, we can reasonably argue that practically the entire 'middle class' would by-and-large be filing the ITR1 or ITR2. It is highly important to note that ITR1 allows annual income upto Rs. 50 lakh while ITR2 removes that cap as well. This implies that in the 2.92cr ITR1 filings and 0.548cr ITR2 filings, there would be individuals who would be earning well above Rs. 25-30 lakh per annum and hence, definitely are not 'the middle class'. However, for argument sake, in the absence of fully delineated data based on total individual salaries and assuming cross-cancellation of such individuals with stray inclusions under other ITR filings, we can safely and conservatively assume that not more than the aggregate of 3.47cr filings under ITR1 & ITR2, i.e. 58.9% of total filings, actually represent the middle class. In purely linear proportional mathematical terms, these 3.47cr middle class filings can't exceed Rs. 12.4/- contribution out of the Rs. 100/- GoI earns (calc: 58.9% x Rs. 21/- contribution by 5.89cr filings). With the maximum limit established, we need to revise it downwards because the remaining filings are by-and-large expected to be high earning filings which would naturally contribute more than a low earning individual due to the dual effect of a higher salary/professional income/business income etc as well as the super-rich tax. Paraphrasing the Pareto Principle, we can hypothesize that the middle class filings contribute a minimum of Rs. 8.6/- out of the Rs. 100/- GoI earns (calc: [1-58.9%] x Rs. 21/- contribution by 5.89cr filings). Thus an average of the two numbers suggests that for every Rs. 100/- GoI earns as revenues or then spends for welfare (I am not even getting into the fiscal deficit side as that will further skew the argument against the middle class), not more than Rs. 10.5/- are sourced from the middle class' income taxes. Going even further, if the same PRS document that I have referenced earlier in this blog is referred to, it can be observed that central subsidies account for Rs 3,55,639 crore (a decrease of 27.1% from previous year). The number represents 9.4% of total GoI expenditure of Rs. 37,70,000 crore. Reconnecting this data to the earlier derived middle class income tax contribution of Rs. 10.5/-, the implication is that of the Rs. 10.5/- income taxes we pay to GoI, only Re. 1/- (calc: 9.4% x Rs. 10.5/-), a single rupee, is being spent on subsidies. The entire amount beyond that single rupee, is going into infrastructure building, defense, technological advancement and daily operations of the government though some does flow into other schemes, grants etc.

At this point thus, it is critical that we delink issues - the strain the middle class has faced in the pandemic is a separate issue, the middle class funding socialist freebies is another separate issue and the very continuity of freebies is yet another separate issue.

On the first, I am empathetic towards those who have had to take income cuts, bear high healthcare expenditure and go through the motions of uncertainty. That notwithstanding, I can also confidently claim that the middle class was not the only one going through financial, physical and emotional pain. I am sure we have all heard and experienced raw tales of survival - the basic human and animal instinct. Economic indicators suggest that the horizon is brighter today than what it was a couple of years or so back.

On the second, the math suggests, our income taxes are not the major financiers of welfare schemes and freebies hence is not relatively significant in the larger scheme of things. However, that doesn't mean I cheer socialism. I have always been dead against any kind of socialism and every socialist move by the Narendra Modi Govt has had me wincing and jumping (Ayushman Bharat, for example, which I am still unsure about economically). But then, more thought and careful observation brought to light that the PM's socialism is nowhere conventional and Marxist. Narendra Modi has demonstrated a different kind of socialism that was surgical in precision (e.g. Swachh Bhaarat, PM AWAS), specifically targeted (e.g. Kisan Samman Nidhi), well budgeted and timebound (Garib Kalyan Anna Yojana) without compromising long-term free markets and economic growth. It appears that trajectory would continue. Nevertheless, all that is currently outside the scope of this blog.

On the third, it will need a great deal of involvement of the citizenry to resolve in the decades to come. That involvement is being more aware, participative and responsive co-operation principle abiding voters. (I have spoken at length on this political angle, especially in context of middle class woes in an earlier Oct 2019 blog Muck is in the Middle). That involvement would also be about understanding the concept of ownership in the government and raising the horizontal above petty issues and focusing on the macros at our end, at the very least. Again, on this very topic, I have shared my views on the Equity and Debt model of governance in a Jun 2018 blog Indian Government: Your, Mine or Ours?).

Finally, I'll love to share a parting tit-bit even as I leave the reader to decide the degree of betrayal in this year's budget:

The first image is comparing night time illumination change and the second one the state of our highways - nine to ten years back vs. today. (Source: pg. 389 onwards of the Economic Survey 2022 authored by Principal Economic Advisor Sanjeev Sanyal).

O Bhaaratiya! Your country, nay my country, nay our country - Bhaarat is changing!

Jai Hind!

No comments:

Post a Comment